Well-known financial advisor and motivational speaker, Suze Orman asked her audience how many had personal debt, of any kind. Almost 100% of the people in the audience raised their hands. To paraphrase her response she said, “So you all have debt, and you come here asking me to show you how to manage money you don’t have?” Such a poignant question. Just like families who discover that they don’t have enough money to pay their bills each month, many small businesses with remote, hourly workers struggle to make payroll, and pay their vendors and other overhead expenses.

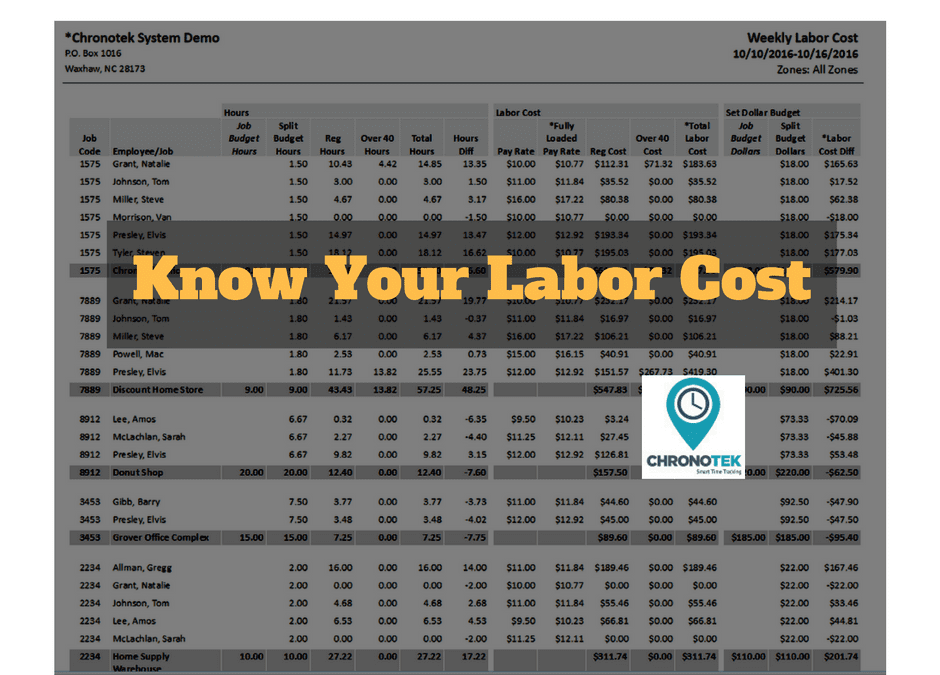

It is hard for small businesses that aren’t efficiently tracking their largest monthly expense: time worked by hourly employees. Our clients have the advantage when they use the new Weekly Labor Cost Report. This report quickly calculates true labor costs (pay rate + payroll taxes) compared to the job’s labor budgets.

In an interview we did last year with David, the owner of a successful janitorial company, he stated that a service business can pay up to 50% of their gross revenues in payroll, but it should not exceed that number. However, we have talked to several small business owners who estimate that they pay up to 70%, and they struggle for a 10-15% profit margin. Profit margins and hourly payroll expenses are tied together in a constant, unequal tug of war. This results in cash flow problems at the very least.

While Suze tries to help her crowd manage money they don’t have, we want to help small businesses reclaim the money that is rightfully theirs. Run the new Weekly Labor Cost Report to stay on track. It’s an easy step towards getting your dream back as well.

Stay tuned and stay in touch by following us on Facebook.