Convert Time Clock Hours and Minutes to Decimals

When you calculate payroll hours each week, do you convert Bob’s 28 hours and 10 minutes of worked time to decimal hour format? And then do the same conversions for 25 other employees? Your head hurts thinking about it because the decimal format is complicated. Well, you can thank the French for the decimal time system, which they introduced during the French Revolution.

In this blog post, we will explore how to convert time clock hours and minutes to decimals, providing you with the knowledge and resources to simplify payroll for your cleaning business or other service-based business.

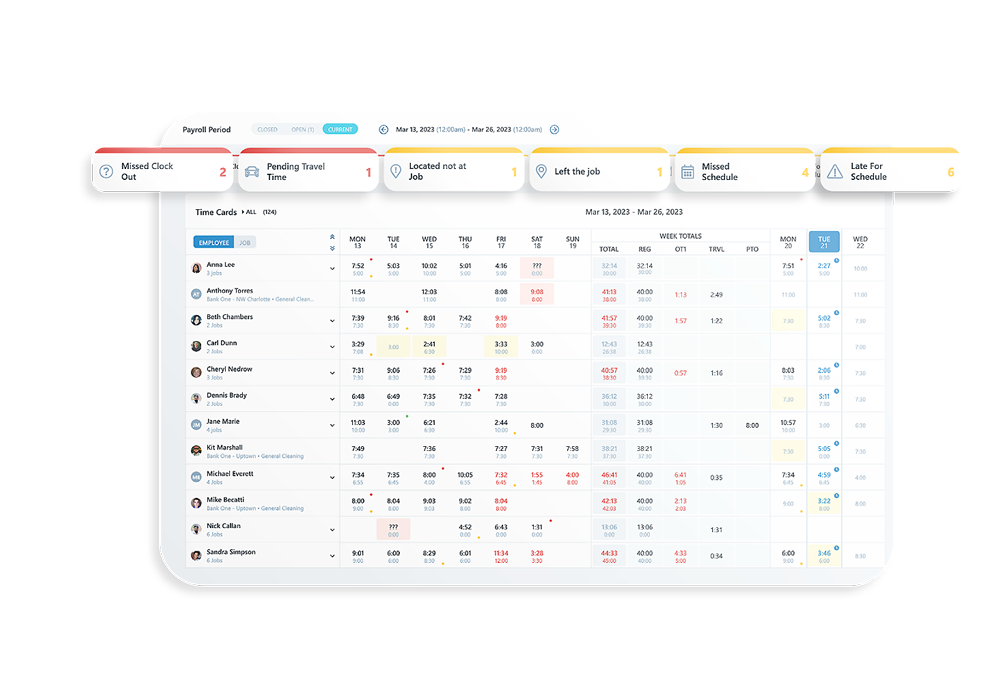

Ready to ditch time-consuming manual time card calculations?

Use a GPS time clock app that ensures employees are always at the job site when clocking in.

Converting Hours and Minutes to Decimals for Payroll Purposes

While it’s easy to convert quarter and half-hour times to decimals, most of us can’t calculate and convert 28 hours and 10 minutes to decimal hours in our heads. Do you know what 10 minutes is as a decimal number? This minute-to-decimal conversion chart helps you quickly convert hours of time to decimal hours, which is handy when converting time frequently. Find the time value on the chart and its corresponding decimal equivalent, and simply enter the decimal form into your payroll system. The time clock conversion table eliminates the need for manual calculations.

Are You Wondering How Much Time and Money You Spend Processing Time Cards?

An admin spends 5-6 minutes per time card each pay period manually verifying total hours and converting the hours and minutes format to decimal hours. This weekly time calculating 11 minutes in decimal can amount to one hour or several, but multiply the number by 52 weeks, and the math equals scary, amounting to hundreds of work hours annually. Tracking attendance this way is costly.

Additionally, the admin's hours worked aren't the only cost factor for companies that manually convert minutes to decimal time. Another example is reading and typing mistakes that can amount to 8% of annual gross pay. Have you ever entered 4.30 into your payroll system when you saw 4:30 on a handwritten timesheet? Unfortunately, that is not how the conversion works, and you short-changed your employee by 12 minutes. A one-minute error is dangerous if employees are closely tracking their hours. It easily happens when you don't understand the decimal numbers format, and honest mistakes like this could be misinterpreted as time card manipulation, also called wage theft.

But there's a better way to get a time clock breakdown, and you'll be shocked by how many minutes and hours it saves you in payroll processing.

Chronotek Pro Eliminates the Need for a Decimal Converter, Saving You Time and Money

Want to save even more time on employee hours and eliminate converting 15 minutes on a timesheet? Chronotek Pro is a powerful employee time tracking system, and time card hours are automatically calculated by your company’s workweek for any pay cycle interval. Your admin no longer has to agonize over the time format or worry about decimal values. Time card reports will display the time converted properly for your payroll company. Say goodbye to manually calculating decimal time and trying to figure out 45 minutes in decimal, and hello to saving money!

Another example of savings that Chronotek Pro gives you is in the 5 time-tested ways it prevents time theft, which includes ensuring your employees are at the job site when they claim to be. You'll no longer need a calculator to figure out the decimal time system, but you may need one to count your profits.

Conclusion

In conclusion, converting time clock hours and number of minutes to decimals is crucial in simplifying payroll calculations and saving time and money. After all, when adding Bob's two shifts of 5 hours 48 minutes and 4 hours 35 minutes, what do you do with 9 hours 83 minutes? Thankfully, the French standardized the math for us. However, the conversion process can be complex and prone to errors when done manually. With the help of a minute-to-decimal conversion chart, a time-to-decimal calculator, and an automated time-tracking system like Chronotek Pro, you can streamline your payroll processes and ensure accurate calculations.

By embracing these solutions, you can simplify payroll processes, reduce administrative burdens, eliminate time theft, and minimize costly mistakes. Invest in an automated time clock system to save time and money while ensuring accurate and efficient payroll calculations. With the right tools and processes, you can focus on more strategic aspects of your business and watch your profits grow.

.png?width=740&height=1114&name=Time%20Conversion%20Chart%20(850%20x%201280%20px).png)